Savant Investors' Idea Spotlight Series #3: Sweetgreen

Why the salad giant is losing the battle for your lunch order.

This idea was published by Savant Investor humboldt01 on February 20th 2024. To comment on this post or exchange DMs with the author, apply or join today at savantinvestors.com

Some email providers may abbreviate this post - full write ups are always available at savantinvestors.substack.com

I believe that at today’s price of $11.6, Sweetgreen has a potential downside of 54% by 2025. I believe that Sweetgreen is a short because 1) its expansion to the suburbs and high restaurant operating costs will limit margin expansion, 2) the robot Infinite Kitchen solves a problem that doesn’t exist, and 3) a bloated SG&A structure will keep SG from becoming profitable and will force the Company to look for financing options in 2025.

Sweetgreen is a fast casual restaurant salad concept based in the United States. SG has 221 stores across the US, mostly concentrated in urban centers, with New York City being its largest market representing 32% of revenues. The Company was founded in Washington DC in 2007 and today is based in Los Angeles, CA.

Thesis #1: Sweetgreen’s Expansion Into The Suburbs and High Restaurant Operating Costs Will Limit Restaurant Margin Expansion

As Sweetgreen expands further, NYC restaurants, which have more than double the revenue (~$5mm) than Sweetgreen restaurants and represent 32% of revenue as of 2022, the AUV growth should start flattening out.

When Shake Shack started expanding outside of NYC, its AUV growth took a hit and its AUV growth declined ~3%.

Cava’s suburban restaurants have AUVs that are 11% lower than urban locations.

As a majorly NYC-based chain, SG’s AUV growth should decelerate as it expands beyond its main market.

Sweetgreen’s AUV growth is behind peers over the past 5 years.

On top of that, SG as a concept is handicapped in that is mostly a lunch spot where 66% of sales come during lunch time, the salad concept is easily replicable and the technological advantage they initially claimed has been severely diluted.

Management is strategically slowing unit growth to 25-26 units and implementing Infinite Kitchens into 7–9 new units in '24 (weighted to 2H), along with 2–4 retrofits. SG plans to re-accelerate unit growth in '25, which might be a sign that they don’t have the capital to grow as fast as they thought.

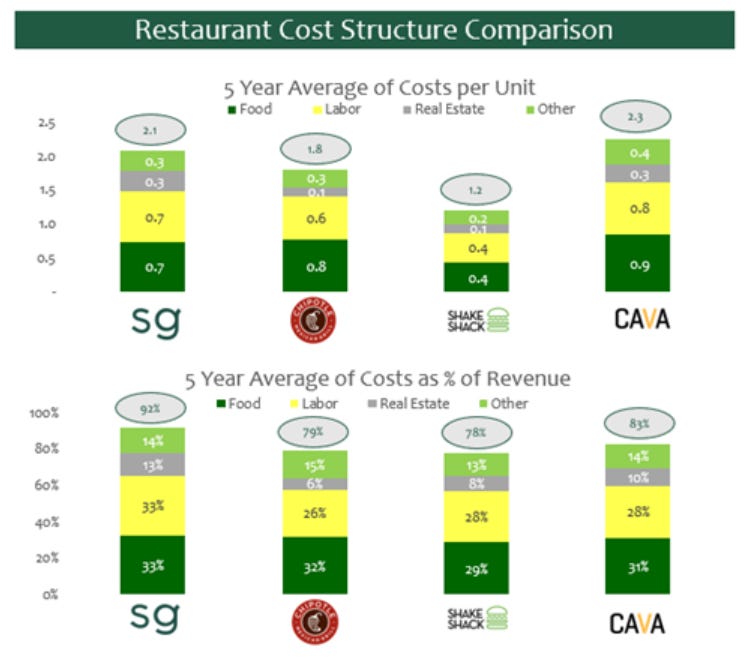

Sweetgreen is disadvantaged vs. peers in two main aspects: labor costs and real estate costs.

No matter how you look, whether on a unit basis or on a % of revenue basis.

For the real estate costs, more than 60% of the leases expire after 2026 with an average lease term of 8 years, thus limiting wiggle room to reduce real estate costs dramatically in the near term.

This leaves labor as the only immediate lever that Sweetgreen can use to decrease unit costs.

Sweetgreen has about the same employee count per restaurant that Chipotle has (30 – 35 employees)

Assuming that SG lowers its labor and real estate expenses to industry % average its box economics will still not be enough to hit that 20% target management is targeting.

Thesis #2: the Infinite Kitchen solves a problem that doesn’t exist

The Infinite Kitchen is an automated restaurant where a robot can serve up to 500 salads per hour, where the robot replaces the assembly line at a traditional Sweetgreen.

The issue is, no restaurant within the existing Sweetgreen network is close to needing to produce 500 salads per hour.

Even at peak lunch rush hour, the machine would have plenty of idle capacity(1)

Sweetgreen introduced 2 restaurants with this tech in 2023: Naperville, IL and Huntington Beach, CA.

Sweetgreen expects to continue rolling out the Infinite Kitchen and plans to roll out 9 to 13 in 2024 (7-9 new locations and 2-4 retrofits).

Though it might remove some employees, the overall cost savings over the life of a restaurant don’t justify the costs.

As the Company continues to roll out this concept, the unit economics and ROICs should decrease proving value destructive.

The Infinite Kitchen reduces SG defined restaurant “Cash on cash” returns from 33% to 29%, way below the Company’s target of 40%-50% at the time of IPO.

Management claims: “While we're not going to talk about the exact cost, what I can say is that the deployment of the Infinite Kitchen will be accretive to our return on capital”. I believe the opposite:

Assuming a $750k cost for the IK, about $150k of maintenance capex per year (SG depreciates its equipment over 5 years) and about $1.5mm in labor savings over 5 years, the IRR on the Infinite Kitchen project is a negative 2%.

On top of everything, The Street is anchoring to this metric and the 26% operating margin per restaurant[2] shouldn’t be sustainable down the road, specially after the Company has repeatedly said that 1st year economics are not representative of the restaurant.

Thesis #3: high SG&A will limit SG’s profitability, cash to invest in growth and will force the Company to raise cash by 2025

Sweetgreen has a higher SG&A than any other fast casual restaurant chain[1] despite growing slower than CAVA, its closest peer (5 Yr Unit CAGR for SG was 18% while CAVA grew 37%).

Beyond excessively high SG&A, there seems to be an oblivious management leading the Company.

Management announced a $10mm HQ cost reduction between 2022 and 2023 (2% of 2022 revenue), still this is not enough.

Among the cost savings was reducing its lease expense at HQ in a building that is owned by the 3 founders and CFO (red flag).

There is a continued focus on Adj. EBITDA as a measure of profitability. However, this adds back SBC, which in 2022 was $79mm (17% of revenue) and an additional $40mm for the first 9 months of 2023. Ex- SBC, the Company is far from EBITDA profitability.

There is a belief that they are a tech company (further evidenced by the ridiculous amount of SBC mentioned above).

A former employee says that upper management seemingly operates by the “move fast and break things” mantra.

The lack of restaurant experience at the board level is another sign of this.

The 3 cofounders control 60% of Sweetgreen through supervoting class B shares and since IPO they have not bought a single share.

Two of them remain in the management team with fluff titles where most of their job descriptions are covered by other people in senior management.

Nicolas Jammet is the Chief Concept Officer and is focused on Supply Chain, Culinary and Restaurant Development. Sweetgreen has an SVP of Operations, a Head of Culinary and Head of Restaurant Development.

Nathaniel Ru is the Chief Brand Officer and is focused on Marketing and Creative & Brand. Sweetgreen has a Head of Marketing.

The combination of limited AUV growth as the company expands, restaurant level profit margins not expanding beyond 18% and a high SG&A burden will force Sweetgreen to look for financing solutions in 2025.

This case assumes a slower unit count growth than the Street estimates (16% CAGR vs. 12% CAGR in my case).

However, if we were to grow at the rate the Street estimates, SG’s capex needs would increase and thus SG would be in a bigger hole in 2025.

Thus, the pure liquidity of the business will limit aggressive unit growth in the business.

Note that for liquidity purposes we add back SBC, but if we were to exclude, the hole in 2025 would be over $100mm.

Valuation & Returns

Assuming that Sweetgreen can get over its financing needs bump in 2025, I believe that it will be worth about $6.40 or $5.29 today (discounted at 10%), a 54% downside from today.

Bear: Based on current model, reaches 300 units, 18% store margins (similar cost structure to comps) and can get some SG&A leverage. Still, it doesn’t produce any positive EBITDA or FCF.

Base: Company executes and increases restaurant margins to 20% and lowers SG&A to industry average. Generates positive EBITDA and at 20.0x (higher than industry terminal multiple), there is ~54% downside to SG’s stock.

Bull: Company executes flawlessly, reaches the 1,000 units target by 2032 at a $3.5mm AUV (higher than CMG), with 20% restaurant margins and SG&A in line with the industry, then SG’s stock could be worth north of $30 in 2032, discounted to today, it would be around $16.

Risks

Unit growth acceleration: Sweetgreen is slowing down its unit growth next year as they implement more Infinite Kitchens. Any pickup after 2025 into unit growth might increase the overall profitability of the company.

Stable to growing AUV as Sweetgreen expands: Any additional AUV growth whether from new hot menu items which could drive additional traffic, higher pricing or volume could increase SG’s revenue growth beyond unit growth.

Take private or activist involvement: After poor performance and a stock price that has declined significantly, Sweetgreen could attract either a buyout, activist involvement (though low probability as the founders control 60% of the voting power) or a take private from a strategic.

Aggressive SG&A cut by management that improves profitability: Management already did a cost cutting program, however small. Any more aggressiveness from them to cut down to industry average would make Sweetgreen EBITDA positive.

High short interest: Currently at 12%, but as a % of float it is 15%. Any run up in the stock might cause a short squeeze.

[1] Assumes a NYC sample restaurant (SG’s highest AUV units) open for 12 hours where ~66% of daily demand falls within the lunch hours. NYC average AUV is $4.7mm and assuming a $16 menu item price, a restaurant serves a total of ~800 salads/bowls per day.

[2] In 2Q23, management disclosed that during its first month the Infinite Kitchen location had 26% operating margins, higher than any first month operation of any SG restaurant. 5-year SG&A average per restaurant for all except for Cava (2-year average) and Portillo’s (4-year average).

[3] 5-year SG&A average per restaurant for all except for Cava (2-year average) and Portillo’s (4-year average).