This idea includes a thorough overview of PayPal’s strategy, provides segment specific insights, and features original customer research conducted by the author.

Some email providers may abbreviate this post - full write ups are always available at savantinvestors.substack.com

PayPal: A high-quality, long-term compounder that trades at less than 10x NTM FCF

PayPal is a global two-sided payments network made up of 35 million active merchants and 400 million active consumers. It is present in over 200 countries/regions. We will look in depth at the consumer and merchant side of the network. This investment thesis is mainly qualitative in nature

PayPal makes its money from transaction fees, effectively a toll between consumers using the PayPal wallet (APM) and merchants using the PayPal checkout. This two-sided network accounts for 90%+ of total transaction gross profit, making it the most important component of the business.

I’m going to address the main fears that investors have regarding the company, including:

Decrease in net new active consumers (NNAs) over the last few quarters

Competition from other alternative payment methods like Apple Pay and Google Pay

Competition from Stripe and Adyen

Decrease in gross margins over the last few quarters

Management's history of poor capital allocation (M&A)

Overall Network Health

We will assess the business using first principles. As PayPal, at its core, is a network, and the fact that the majority of revenue is tax/toll on this network, this is the critical area we must scrutinize. If the network is not in good health and deteriorating, with valuable nodes leaving, in turn, the business would also be degrading. PayPal would have a diminished ability to extract transaction fees, and you could have little confidence in the durability of future cash flows. If, on the other hand, the network is healthy and growing in strength, with valuable nodes using the network more frequently on both sides, then we can be more confident that future cash flows will be durable and grow over time.

Networks follow the basic but fundamental principle that as more nodes join and interact with the network, it becomes more valuable for each additional node. As this is a two-sided network, more merchants accepting PayPal make it more valuable for each additional PayPal consumer, and vice-versa. This is because it becomes more efficient, easier, and effective to move the network flow (payments) between the two types of nodes. This is most easily measured and evident in the checkout conversion rates using PayPal vs. competitors (I go through this in detail on page 6.)

To ensure this ongoing conversion advantage, the network needs to remain healthy. We must look deeply at the nodes (consumers/merchants) and the network flow (payment between nodes). We can roughly see this overall health by visually graphing the growth of each component. We will look at the data from the last seven years (since it was spun out from eBay and the data is for the year beginning).

From looking at the overall trend of those key network metrics, we can see that the network seems to be in a strong position. It has an all-time high number of transactions per active consumer account (network engagement), payment volume (network flow), and active merchants. Now, it is important to recognize that net new active consumer accounts have slightly decreased over the last two quarters by approximately 1m users. I address this concern in detail on page 7.

One must also appreciate that this growth has not been achieved in a vacuum. PayPal has been up against significant competition over the seven-year period we’ve looked at. This includes Apple Pay, Google Pay, Stripe, Adyen, and countless other competitors. But they have still managed to triple the size of the network, triple profits, triple free cash flow, and more than triple transactions per active account.

Across PayPal’s life, it has encountered a number of competitive threats, many of which were supposed to bring its demise:

The mobile wireless carriers, including AT&T, T-Mobile, and Verizon, got together to take on mobile payments in a joint venture called ISIS, along with the unfortunate name it was ultimately unsuccessful and unable to hit critical mass. It was disbanded in 2016.

A group of big retail merchants came together with MCX to take on mobile payments, MCX is a consortium of major retailers, including Walmart, Target, and Best Buy. MCX launched a mobile payments platform called CurrentC in 2014. It was also unsuccessful, and it was discontinued in 2017.

Each of the large US banks tried to put their own checkouts and alternative payment methods (APMs) on merchants, but they were also unsuccessful. You then had the dominant card networks Visa, Mastercard, and American Express try to introduce their own APMs (for half the price of PayPal’s merchant fee), and again, they were unsuccessful.

These competitors were not small, underfunded start-ups; they were each behemoths in their own right, and often they teamed up together to try and take on PayPal. Why has PayPal been able to maintain this dominant position? And why will they be able to remain dominant in the future?

The reason is that they greatly improve the ease, efficiency, and effectiveness of moving payments from consumers to merchants. This is what the two-sided network provides and is most evident in PayPal's checkout conversion rates.

Conversion of a PayPal Checkout

Nielsen conducted a study of desktop transactions from 15,144 US consumers between July 2020 to September 2020. The research analyzed the purchase behaviors, conversion, and spending of these consumers. The merchants included 73 of ‘Digital Commerce 360’s’ top 100 merchants (all large enterprises).

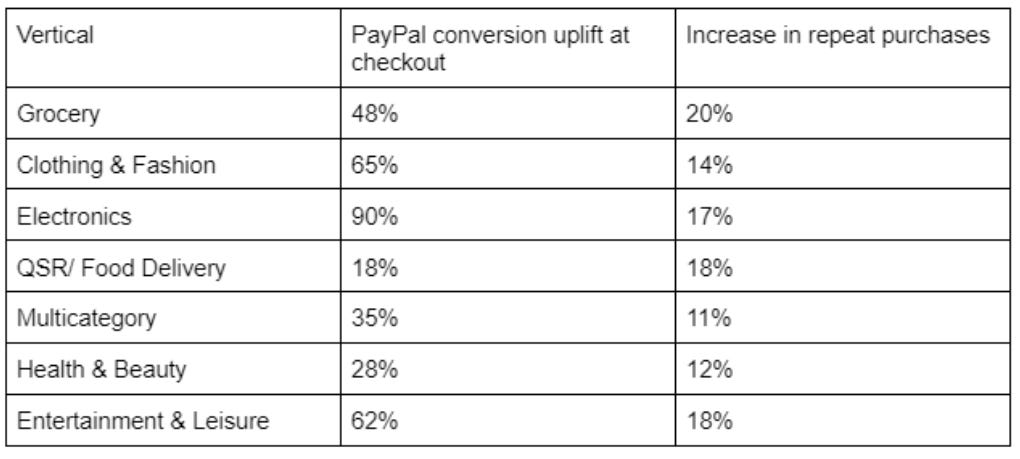

On average, merchants saw a 28% increase in conversion when PayPal was selected at the checkout. Consumers were also 2.8x more likely to convert on sites where PayPal is visible. You can see the different PayPal conversion uplift at checkout and the increase in repeat purchases for different verticles below.

The reason why people convert at a higher rate is because PayPal’s network makes it much easier and more efficient to complete the checkout process. It takes effectively one click vs. entering all your contact, shipping, and card details for the checkout. It reduces friction. They were the first to build a critical mass of APM users on one side and merchants on the other.

What PayPal also does is increase the trust between the merchants and consumers. Consumers know that when they use PayPal on a merchant's website, they are more protected against fraud, especially if they have never bought from that merchant previously. This is the power of PayPal’s brand, which has been built over twenty years. It gives consumers the confidence to trust a merchant they have never dealt with before.

However, for PayPal to maintain this conversion advantage, they need to keep both sides of the network healthy. To begin, we will look in-depth at the consumer.

PayPal’s Consumer Side of the Network

Focus on Quality over Quantity (MAUs vs. Net New Actives)

For many institutional investors, the most worrying element of PayPal’s recent results has been the lowering of expectations regarding net new active customer growth (NNAs) and the recent decrease in NNAs by around 1% over the last two quarters. When management originally gave guidance in early 2021, they were far too optimistic regarding NNA growth. They also clearly overlooked that during COVID, a lot of NNA growth was of poor-quality users who did not engage or interact much with the network. As a result, the churn of these users has been elevated over the past year, outweighing the growth of higher quality users and, hence, the NNA number being slightly down. This fear regarding NNAs that many investors have is a misunderstanding of how networks operate. Not all nodes are equal in their value.

Management has altered its strategic focus from growing NNAs at all costs to instead, prioritizing the quality of users and their usage of the network. This is exactly what shareholders should want from management. The most important and valuable nodes to any network are those that use the network most frequently. The more consumer nodes use and engage with the PayPal network, the more valuable it is to PayPal merchants and vice versa.

A useful way to explain the importance of focusing on quality vs. quantity of nodes is to look to nature, and I will give a quick example.

A tree, like PayPal, is a two-sided network. It has roots below ground and branches/leaves above ground. Each side of the network has a core job; the branches and leaves are for absorbing sunlight/gases for photosynthesis, and the roots below ground are for absorbing water/nutrients. Together, these two sides help create glucose. When a tree is growing, there is a phenomenon where unwanted shoots sprout from the base of the tree. They are below the canopy and get a fraction of the sunlight. They are affectionately called “sucker growth” or simply “suckers.” They use up valuable nutrients and energy from the tree to grow and will never be able to provide any value due to being below the canopy. They receive no sunlight, and therefore, no photosynthesis can occur, which means no glucose production. The energy that could be used for fruit production or growth of the primary branches or foliage is instead wasted on these “sucker growth” nodes. Due to the lack of sunlight, they are also weak and susceptible to disease. An arborist, someone who manages trees, is trained to cut off these “suckers” as soon as possible so that the two-sided network - the tree - can focus on productive growth and use of energy.

Nature tells us that not all nodes are created equal. Some have a significantly higher value to the network, typically by a factor of 20 or 30 times.

It is the exact same situation with PayPal's consumer side of the network. During COVID, they acquired low-value users in regions where they do not have strong PayPal merchant penetration. These are nodes that use the network once or twice and churn. They provide little value to the network and, like tree “suckers,” should not have energy or, in this case, marketing dollars thrown at them. They also use up a disproportionate amount of customer service or KYC bandwidth that can be better focused on nodes that are worth far more to the network.

Dan Schulman made it clear multiple times over recent quarterly calls that they have been “churning out the kind of one and dones predominantly in LATAM [Latin America], Southeast Asia, [and] India.” He has also said, “we are not spending marketing dollars to try and incentivize them to do one more transaction with us, because as we've found over time, this is negative ROI.”

To highlight this focus on quality, management has recently started reporting monthly active users (MAUs) in quarterly calls. PayPal currently has over 190 million MAUs. These nodes are, according to Dan Schulman, “20, 30 times more valuable” than those nodes that are not. MAUs use the network for “70 to 90 transactions” a year, “ have really low churn rates … [and] drive the overwhelming amount of our TPV on our platform.” These are incredibly important nodes to the network.

The great news for PayPal shareholders is that these MAUs have grown this past year by about 1%, so approximately 1m to 2m users. This is what the market should be focused on - not net new active users. If PayPal were losing MAUs, this would be deeply troubling, as the network would be weakening in its value, and we could not be confident in the durability of future cash flows - it would be a potential value trap. The market is focused on the wrong metric. NNAs will recover over time but will temporarily grow at a lower rate due to the churning out of poor-quality users.

With this renewed focus on quality, the latest consumer cohorts are improving in usage and ARPU, which is also great news for shareholders.

From the 2023 Q1 call, Schulman mentioned that the 2023 March cohort (consumer nodes that had signed up that month) had 24% higher transactions per active (TPA) and a 40% higher average revenue per user (ARPU) when compared to the March cohort from 2022 (over the same time frame). Furthermore, in the June 8th PayPal management presentation, the May 2023 cohort had a 9% higher TPA in the first month of signing up and a 28% higher ARPU vs. the May 2022 cohort.

The cohort data highlights that node quality looks to be increasing substantially on the consumer side of the network, which further improves the value of the network to merchants and vice versa. Again, the market is ignoring this improvement in user quality and its impact on the long-term durability of the network and its cash flows. If consumer nodes are increasing in their use of the network (TPA), moving more network flow (ARPU), this drives a similar increase in value for merchant nodes. As networks follow the economic principle of demand-side economies of scale, as demand increases on one side, this drives more demand on the other. Both sides become collectively locked in.

Market Share and Demographics of Consumer Nodes

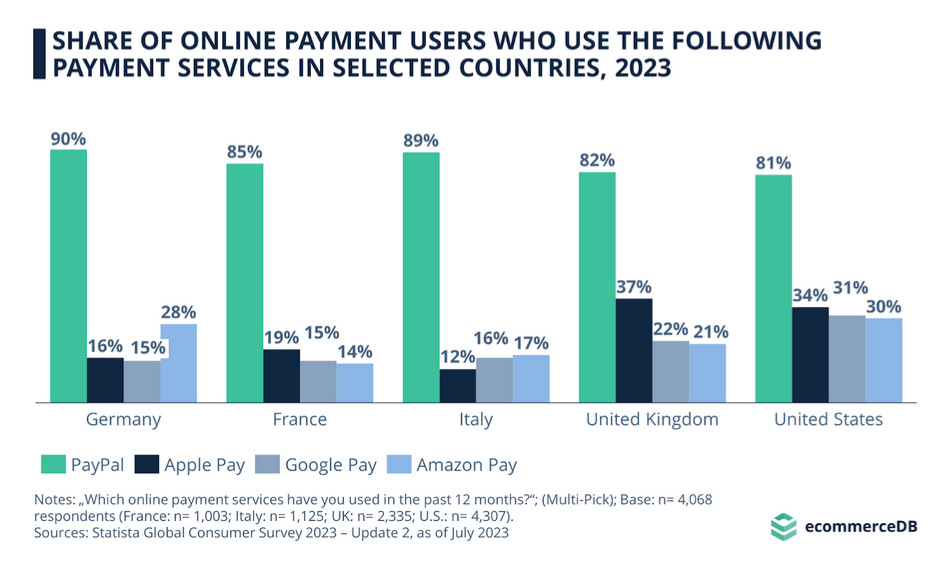

Note above data doesn’t include ‘Pay with Venmo’. Statista survey from July 2023.

You can see from the data above that PayPal dominates regarding usage as an alternative payment method (APM). Like most network-effect businesses, once you’ve used PayPal many times for many years, there is little reason not to use it when offered at a checkout. After all, it’s the quickest and easiest way to pay; you trust the brand, and you don’t have to enter your card or personal details. Users don’t bother switching - unless there is some huge improvement to be made by doing so. Apple Pay and Google Pay do not provide any 10x improvement when it comes to e-commerce, especially with PayPal’s latest mobile software development kits (SDKs) and checkout integrations (PPCP and Braintree). They are on par or even have lower conversion rates than PayPal’s APM.

In the US, PayPal is the dominant choice across all generations, especially those in the 1965-1979 and 1946-1965 age demographics. These users will likely continue to use PayPal for the rest of their lives for e-commerce. As people age, they tend to take less risk changing from a tried and trusted method. If we also included ‘Pay with Venmo’, PayPal’s dominance of the younger generation is even larger than the above data indicates - likely taking them to well over 80% usage for both 1995-2012 and 1980-1994 categories.

I’ve also conducted a study that backs up this consumer preference for PayPal vs. other APMs. I wanted to see what shoppers would pick if they had to choose between PayPal, Apple Pay, Google Pay, and Venmo at a checkout. They could only pick one.

Which payment option is most preferred by US online shoppers?

I conducted a consumer survey on October 21st with 991 US residents.

I used Prolific, a market research platform that is the industry standard for academic surveys. Demographic data is included at the end of this report, on page 33.

Survey respondents were shown the following screen, using the same size APM buttons and their usual color schemes and layouts used on checkouts (ordering of options was randomized for each respondent):

Results

Q: When you’re shopping online what payment option do you pick?

Survey APM results by age group

In this survey, PayPal dominated all age categories, especially those in the 1980 - 1994, 1965 -1979, and 1964 and older, with over 70% preference in each. Even with those born after 1995, PayPal and Venmo were still chosen a combined 67% of the time. PayPal has a substantial consumer preference advantage for its APM. This is not a network that is under imminent threat of collapse.

Apple Pay is doing a good job with the 1995 - 2012 age category, with 27.1% giving it top preference. This is something PayPal management needs to rectify, but this is hardly what I would call panic stations. The future free cash flow generation of this economic castle is still very well protected. Consumer nodes show a much higher preference for PayPal over the two strongest APM competitors, Apple Pay and Google Pay. Remember, demand on one side of the network fuels demand on the opposite side - they become collectively locked in.

The moat has not been breached. The gulf between reality and the market’s perception is massive. PayPal's next twelve months' FCF is priced at less than ten times - as if the castle walls were crumbling with Apple Pay storming the gates. Market perception doesn’t match reality.

PayPal Wallet and App

One area where management has been investing heavily is in the PayPal wallet and app offering. The reason for this is that it further strengthens the usage by consumers, which, in turn, further improves the value of the network to merchants and vice versa. From management's recent comments in quarterly calls, around half of the consumer base uses the PayPal app - with around 10% growth YoY.

A PayPal app user has a “50% greater ARPU than non-users,” a “47% lift in checkout TPA” and churn that is “25% to 33%” lower.

Those are impressive numbers, and management realizes this is a huge opportunity. They have been using monetary incentives to get users to download the app and begin using it. The app contains a rewards program, cashback, shipping tracking/updates, easy subscription tracking, smart receipts, and branded debit/credit card offerings.

During the June 2023 Management Presentation, Chief Product Officer John Kim mentioned that there were over 10 million PayPal users who have their card rewards or cash back set up in their digital wallet (in the app) and have that automatically applied when they checkout. This is up 20% quarter over quarter, and consumers who are utilizing those rewards now have 32% greater TPA.

The PayPal app, in terms of popularity, is ranked in the top 3 for all free finance apps in the major regions, including the US, Australia, Canada, France, Germany, the UK, and Italy (both Apple App Store and Google Play Store).

BNPL

The BNPL segment has been a heavily saturated market over the last few years. Numerous cash flow negative companies have been trying to grow at all costs in the space. There is Affirm, Klarna, Afterpay, Zip Pay, and Apple Pay Later, to name a few. Most of these companies have no clear path to profitability (ignoring Apple of course). With the cost of capital vastly increasing over the last year, most of the BNPL market share these profitless, cash burners have acquired will likely be lost over time as they have to tighten the purse strings. They won’t be able to rely on using expensive marketing/promotion to acquire customers. It will instead be who provides the best value for merchants and consumers while maintaining good quality lending standards.

BNPL for PayPal is a way of improving the efficiency and value of their two-sided network. For consumers, it means they can spread the cost of an item over a longer period, helping with liquidity issues, and for merchants, it increases conversions and average order size. PayPal’s BNPL currently has over 32 million users and 2.7 million merchants with it enabled.

Chief Product Officer John Kim mentioned in the June management presentation that BNPL generates a 12% lift in sales for merchants and a 55% increase in average order value (AOV). J.P. Morgan also did a survey in early 2023 asking consumers who is their favorite and preferred BNPL provider. PayPal came out on top with a consumer preference of 43%. Equal to the next three competitors combined. Source: J.P. Morgan, Online Checkout Survey, January 2022,

n =1,053.

PayPal bundles in BNPL at the same price as their PayPal checkout button, at 3.49% plus 49 cents. This is well below the cost of other independent providers that generally charge merchants over 5%. To offer BNPL is a simple click of a button for a PayPal Complete Payments (PPCP) merchant, an incredibly easy and quick way to uplift sales and AOV.

It is also a very high-margin offering for PayPal as the funding mix is predominantly ACH and Debit Cards. PayPal doesn’t disclose the exact funding mix, but the Vice President in charge of the pay later offering, Greg Lisiewski, confirmed in 2022 that it is nearly all debit and ACH. Autonomous Research estimates that it is 30% ACH, 65% Debit Cards, and 5% Credit Cards, while another firm, Earnest Analytics, estimates that it is more skewed towards ACH. Either way, the funding mix is likely cheaper than the already high-margin PayPal-branded checkout button due to much lower credit card usage. PayPal has also maintained industry-low loss rates because they have an extended transaction history with users, providing a competitive advantage from an underwriting perspective.

With BNPL comes lending risk and having to tie up capital to loan out. However, with the KKR deal announced a few months back, PayPal can get billions of dollars of European BNPL receivables off the balance sheet, reducing both credit risk and improving returns on capital. PayPal also, in the past, did the same with their PayPal Credit product and sold off the receivables to Synchrony Financial, significantly improving ROIC. It’s likely that PayPal will eventually try to do the same with the entire or majority of the BNPL receivables. Management has stated they want to remain an asset and capital-light business.

BNPL is another valuable, high-margin addition to PayPal’s network, helping drive more demand for both sides and further strengthening the network’s defensibility. The company has achieved impressive TPV growth rates of 160% YoY in 2022 and also a superb NPS score of 81.6.

Venmo

Venmo is a P2P payment network with 90 million YAUs and 60 million MAUs. It is primarily used by those in the 18-29 and 30-49 age brackets. They also skew towards having middle/upper incomes. The competing P2P networks are Cash App and Zelle. Each dominates different social-culture demographics, and they tend to monopolize those nodes that belong to the same friendship groups or families.

Users can split payments, pay each other for items, or send funds for whatever they please. It also has features for recurring expenses to be made automatically (like the share of rent due).

Venmo was the first app in the US to build a critical mass of P2P users and has even become a verb in its own right - to ‘Venmo’ someone. Traditionally, Venmo has been unprofitable for PayPal as there have been few ways of monetizing the network. Currently, Venmo charges a 1.75% fee (min $0.25 and max $25) for instant payments to bank accounts and 3% to use a credit card as a funding source. They also have recently introduced Venmo debit and credit cards to generate interchange fee revenue (as an issuer).

Because of Venmo’s past history of being unable to monetize its users at scale, it currently only contributes around 5% of PayPal’s overall group transaction revenue and less than 1% of gross margin. Due to this, it has never really captured investors' imaginations when placed right next to the branded PayPal APM and Braintree. Analysts have largely ignored it all together - this is a mistake.

The funding source for most Venmo accounts is via ACH and debit cards. Both are very cheap funding sources for Venmo, likely with ACH being only a few cents and debit cards being below 35 cents per transaction (with around half falling under the regulated debit card interchange fee cap). In the foreseeable future, Venmo will likely use FedNow for its back-end funding of accounts to have near-instant transfers into and out of Venmo - further decreasing funding costs dramatically (FedNow costing only 4.5 cents for the sender). Using FedNow instead of ACH for transfers would temporarily have the impact of cannibalizing fee revenue that Venmo can generate for instant payments to bank accounts. However, this is a minor and temporary price to pay.

The benefit of Venmo’s low-cost account funding mix (which will only get cheaper over time) is that its underlying cost structure for ‘Pay with Venmo’ - the branded wallet checkout button - is also, therefore, inherently very low. The approximate funding mix for Venmo accounts is 70% ACH, 28% debit cards, and 2% credit cards (Source: Earnest Analytics data from Q2 2019 - most recent data I had access to). If we reasonably assume the following costs: 5 cents per ACH, 35 cents per debit card transaction, and zero for credit (as Venmo surcharges all credit card transactions at 3%), we can reach a rough funding mix of 13.3 cents per transaction.

This is the key reason why Amazon has chosen to have ‘Pay with Venmo’ as an APM for its customers. Venmo does not have to pay any additional interchange or scheme fees when users choose to pay with the service other than the original account funding source. This essentially cuts out the traditional Visa/Mastercard network and their high interchange fees from the checkout.

By doing this, Venmo can offer much lower processing rates to the likes of Amazon while maintaining a healthy gross margin on each transaction. This is the reason why ‘Pay with Venmo’ is the only outside APM allowed on Amazon. Amazon has little incentive to add competing APMs like Apple Pay or Google Pay as they have a much higher underlying funding mix.

Amazon does not disclose its average cost of card acceptance. However, we can use Adyen’s cost of acceptance as a proxy. Both have very similar average transaction sizes, card mix, and processing volume, although Adyens skews more to Europe, which is cheaper due to the capped interchange fees. Adyen’s blended cost of acceptance (interchange plus scheme fees) is around 98 bps on approximately 800 billion in TPV. We can reasonably assume that Amazon is likely paying at least 98 bps on average for its cost of acceptance, which equates to around 5 billion dollars a year in card fees.

The average transaction value on Amazon is $47; assuming the blended funding cost on Venmo’s side is 13.3 cents on average, this equates to a cost of around 28 bps on $47. Venmo, hence, has the ability to offer low rates to Amazon, with likely a 10 to 20 bps margin on top. This potentially saves Amazon significant sums in card fees when customers choose 'Pay with Venmo' (98 bps debit/credit cards vs. 40 to 60 bps with Venmo). Large merchants like Amazon are able to use this as leverage with the likes of Visa and Mastercard to get better rates.

As Venmo has already built a dominant P2P network, PayPal has been able to layer these 90 million Venmo users into their already dominant two-sided payment network. Below is a rudimentary diagram of this layering.

Venmo will become a more dominant APM over time as very large merchants prioritize its acceptance due to its much lower cost. They have a massive incentive to offer the APM on the checkout and will likely want to funnel as many customers as possible to use it. Amazon, for context, is nearly 40% of all e-commerce sales in the US, with more market share than the following twenty online retailers combined. Amazon is the largest and most valuable merchant node available.

By building this acceptance in the very biggest merchant nodes first, PayPal can then further strengthen the two-sided ‘Pay with Venmo’ network through increasing usage and interaction by Venmo users. After building this, they can go after the long tail of PayPal’s 35m merchant nodes (SMBs), who will be more likely to want to accept Venmo at the 3.49% + 49 cents due to its consumer demand (built from interacting with large merchants). This long tail of merchant nodes is where the gross margin for PayPal will be extracted.

Potentially, what merchants like Amazon could be charged for ‘Pay with Venmo’ (might be lower), and the possible gross margin for PayPal:

What the long tail of PPCP merchants will be charged for ‘Pay with Venmo’ and potential gross margins:

The gross margins are potentially extremely high on the 3.49% + 49 cents that smaller merchants will be charged to accept ‘Pay with Venmo’ - probably over 90%. These are Visa/Mastercard levels of gross margin. Considering the traditional PayPal branded checkout (its current highest margin offering) is around 70% to 80%, ‘Pay with Venmo’ is a massive opportunity for PayPal and dangerous for all competing APMs.

In terms of how the current ‘Pay with Venmo’ relationship is progressing with Amazon, we can look at recent comments made by Dan Schulman in the August 2023 analyst call:

“…pay with Venmo is really continuing to expand and get some traction. We added 27 new merchants in the quarter from Xbox, to Mercari, to GoFundMe, to McDonald's, Starbucks either came in at the end of Q1 or in the beginning of Q2. We’ve got a strong pipeline. All of those are increasing pipeline as you see PPCP as well as upper entry continue to expand. We saw 70% plus year-over-year growth in [Pay with Venmo] TPV. The Amazon partnership is continuing to strengthen. They've put us now on Prime and on Turbo Checkout. Once that happened, we saw another 21% lift in first-time users. During Prime Day, we saw like seven times leap in first-time users. And by the way, our TPV is still running well above pre-Prime Day averages. There's a lot to like about what's happening in the Venmo business. The credit cards are up around 60% year over year in terms of growth and actives [Venmo credit card issuing].

So each of those merchants that we bring on, obviously, it takes time to ramp up, but you may have seen or not - when we bring on somebody like a Starbucks or a McDonald's, they start to do immediate marketing with us to drive Pay with Venmo. So those build over time, that's why I mentioned kind of you're seeing [Pay with Venmo] TPV grow at an increasing rate now. 70% is what we saw last quarter, but it's an increasing rate of growth. And so, the more merchants we can put on to that, the better monetization we'll do in Venmo. And those are all very high-margin checkout transactions for us. Especially so given the funding sources inside Venmo, which is predominantly debit and balance as opposed to credit. “

It’s unsurprising that ‘Pay with Venmo’ TPV is up 70% YoY. With such a low-cost funding fix for ‘Pay with Venmo’, it is a very attractive APM option for large merchants like Amazon, McDonald's, Xbox, and Starbucks. Due to Venmo’s current tiny contribution to revenue and FCF, Venmo is basically included free in terms of the overall price you’re paying for PayPal. For the long-term-oriented investor, Venmo could potentially generate billions of dollars in FCF over the next ten years. I think it is less a matter of if - but a matter of when. Patience will be rewarded.

Now that we have gone through the consumer side of PayPal’s network, we must also look at the merchant side.

PayPal’s Merchant Side of the Network

Over PayPal’s life, it has sold a variety of different payment service provider (PSP) offerings to each different merchant segment, typically with a different backend and codebase for each. Management has realized the importance of simplicity in maintaining and updating the code and consistency in the UX for consumers. PayPal has gone from multiple different platforms to a 2-platform strategy: Braintree and PayPal Complete Payments (PPCP).

Merchant Node Quality and Market Share:

As I’ve alluded to earlier in this piece, not all nodes are equal in their value to a network. This difference is most pronounced between different merchants, with some being thousands of times more valuable to the network than others. I’m referring to those PayPal merchants like Walmart, Home Depot, Best Buy, Target, etc. The top e-commerce players in terms of total processing volume are the most sought-after nodes in a two-sided payment network like PayPal. They are the hardest to win but most integral to the health of the network.

The great news for shareholders is PayPal dominates this segment of very large merchant nodes. They have achieved over 80% penetration of the top 1500 e-commerce stores in North America and Europe with the PayPal button. While they likely make a much lower gross margin from these huge merchants, what it does do is drive significant usage with PayPal’s 400m users. These consumers then visit the long tail of PayPal’s 35 million merchants, who then pay 3.49% plus 49 cents for each transaction - this is where the gross margin is extracted from the network.

APM acceptance among the 1,500 largest online retailers (North America & Europe):

Source: Digital Commerce 360 - 2021 and 2022 North America Top 1000 and Europe Top 500 databases

Over, the last few years PayPal has grown acceptance at a faster rate than competing APMs in the top 1,500 merchants.

The big merchants drive usage, while the small merchants drive margins. PayPal has impressive pricing power for the branded APM button, having recently increased the processing rate from 2.9% plus 30 cents to 3.49% plus 49 cents. On PayPal’s average transaction value of $60, this is a 20.5% pricing increase. This change was made in August 2021.

The funding mix for PayPal is significantly lower than all other APMs, including Apple Pay, Google Pay, Amazon Pay, etc. This is due to the fact that these competing APMs use only debit or credit cards as the underlying funding source, with no ACH, and as a result, have a much higher underlying cost. While PayPal can cheaply offer its highly efficient and effective APM to very large merchants at a deep discount, other APMs simply cannot compete on rates. PayPal’s high ACH mix gives it a structural pricing advantage that is potentially half the cost of the competition. Other APMs like Apple Pay are unlikely ever to be able to replicate this funding mix due to the fact that they rely upon Visa and Mastercard’s payment rails for their APM. The market again does not appreciate this structural pricing advantage. PayPal can undercut the competition with its branded APM button on very large merchants and give them no reason to offer alternative methods because it would just drive up their fees.

PayPal has actually gained market share on Apple and other APMs with their top 100 merchants who use their latest checkout. Again, this fear of Apple Pay eating PayPal’s lunch is significantly overblown, and in reality, the opposite is occurring.

PayPal doesn’t just dominate the top 1,500 merchants with its APM; it also dominates approximately the top 40,000 merchants. Knoji, a website that tracks e-commerce websites across the US and EU, captures this data.

Over the past three years, each of the APMs had the following penetration of approximately the top 40,000 merchants. (Data extracted using Wayback Machine).

You can see that over the last three years, PayPal has added around 305 net new large merchants vs. Apple Pay’s 143 or Google Pay’s 185 per month. Again, this illustrates the strength of PayPal’s two-sided network is increasing with time. If one side grows, the other follows.

Churn of APM acceptance among merchants

Morgan Stanley Equity Research mapped the gross churn rates of different APMs over the last few years, from Q4 2019 to Q1 2023. Churn, in this instance, refers to the measurement of total customer contraction during a quarter, expressed as a percentage of the previous quarter's count of merchants accepting the digital wallet.

PayPal's gross churn rate was found to be very low among merchants, generally less than 1%. This highlights the value of the network for merchants - if the APM were not worth the fees, they would remove it.

However, for the other APMs, the gross churn among merchants was significantly higher - some by a factor of six times. Amazon Pay, Google Pay, and Shop Pay had around the same average quarterly churn of 4%, while SRC (the Visa, Mastercard, and Amex Click to Pay Button) churn was even higher at around 6% a quarter. Unfortunately, they didn’t look at Apple Pay, but it likely has a similar churn to Google Pay (it will likely be lower).

This difference in merchant churn among APMs further illustrates that PayPal’s network is incredibly valuable to merchants and the dominant choice. Churn has also remained stable over this three-year period, which further shows that the value of the network has remained stable - even though the share price would indicate otherwise. Merchants don’t choose to offer PayPal out of kindness but because it helps generate more sales. Again, the market does not appreciate or understand the value of this best-in-class retention of merchant nodes. If the network were weak, PayPal’s merchant churn would be increasing over time; however, it has not really changed at all over the last three years, again suggesting that the network is currently in great shape.

Braintree

Braintree is PayPal’s enterprise payments service provider (PSP) offering. It gives high levels of customization and sophistication for large merchants. This is PayPal's unbranded segment. It is a much lower gross margin business and is typically an interchange-plus pricing model. Braintree also has value-added services for merchants, like risk-as-a-service, back-office automation, and payouts.

Its two main competitors are Stripe and Adyen. Stripe tends to be used more in the U.S. and by SMB merchants, while Adyen is more skewed towards Europe and predominantly large enterprises. Braintree typically competes most against Adyen, but Stripe is still a strong player in the enterprise space.

Adyen has around 2,300 customers, Braintree 6,600, and Stripe 2 million. They each effectively provide a similar enterprise offering.

Braintree processed around $300 billion in 2021, $408 billion in 2022, and is on track to do around $530 billion this year. This is a business growing at over 30% YoY. The majority of this growth is coming at the expense of legacy acquirers and gateways. However, they’ve also been recently taking share from both Stripe and Adyen.

Large enterprise merchants will generally have multiple PSPs built into their systems to ensure they can always accept payments in the event of downtime with one PSP. This leaves the door open for providers to come in as a backup or alternative and later become the majority processor if they can have better authorization, loss, and processing rates. This is what Braintree has been doing to the likes of Adyen.

The good news for PayPal shareholders is that it is not really a fair fight. PayPal has 35 million merchants (vs. Adyen’s 2,300), and over a billion unique consumers use PayPal’s checkouts every year. This means the company can collect huge amounts of proprietary data needed to optimize auth and loss algorithms across the whole group. Granted, Adyen would still have very impressive algorithms, but it is unlikely that they have the same quantity of data that PayPal can access and, hence, would struggle to be as effective.

Braintree can also underprice competitors like Adyen with interchange-neutral rates - effectively offering their PSP at the cost of interchange. Adyen’s CEO and many analysts believe this is unsustainable, and on the face, it would seem to be - how can a PSP price at cost for a sustained period?

This ignores a crucial advantage that Braintree has: their low-cost funding mix APMs - the PayPal and ‘Pay with Venmo’ buttons - that are between 50% to 70% ACH. Braintree can bundle these APMs into their PSP offering at very sharp rates. Potentially charging significantly less than Adyen's 25 bps average take rate while still making 30% to 50% gross margins on the branded PayPal APMs. This is why Braintree can price all other payment types at interchange-neutral. The market seems to be missing this key advantage, and I would be worried if I were an Adyen or Stripe shareholder. Braintree will continue to grow at very high rates by undercutting rivals, who are without their own low-cost funding mix APMs.

Morgan Stanley estimates that Braintree is currently pricing around 50% below Adyen in the US while increasingly being able to match Adyen’s enterprise solution. At the same time, Braintree is also building out its international functionality. Stripe seems to be staying out of the pricing fight altogether - not surprising, considering they are yet to turn a profit.

AlphaSense, a market intelligence platform, conducted an interview with a Booking.com employee involved with the payment processing of the company. This internal expert described why they shifted volumes to Braintree away from Adyen over the last 12 months.

The reasons they gave for the switch were initially for redundancy and Braintree’s strong US presence. But also, “the discount we got on PayPal, which is our biggest wallet share globally and actually accounts for a pretty big chunk of our wallet volumes …, [when you combine] that they threw in attractive rebates on the payment side, that became a very, very strong financial competitive advantage. It became a bit too hard to miss out on”.

This again illustrates this APM funding mix advantage that PayPal has.

Dan Schulman described their Braintree strategy as follows:

“We are going to drive hard on our PSP (payment service provider, i.e. Braintree) businesses. We are winning in the market. You can see it in the results of our competitors as well. And the way that it typically works is we grab like 20% of a very sophisticated merchant, the Ubers of the world, the Airbnb’s, Spotify’s, DoorDash, you name it. Most of the big ones are using us now. We come in, we grab about 20% as an alternative provider. And then what happened — and pricing is always competitive there — then vendors or merchant partners evaluate you on uptime. They evaluate you on auth rates and loss rates. And typically, what we find is we go in at 20%, our uptime is equal to or better than any of our competitors, and our auth rates and loss rates are better. We have more data, more information. We go from 20% to 40% to 60% to 80% to 90% of the traffic over anywhere from like 6 months to a year.”

Adyen’s recent results showed a worrying decrease in their TPV processing growth (23% YTD), largely because Braintree shifted volumes away from the company. In comparison, PayPal's Braintree posted a 30% increase in revenue growth and payment volume growth, both in line with last year's growth.

Due to Braintree growing at such huge percentages, the overall gross margin of PayPal as a group is decreasing. Many investors and analysts are worried about this and have concluded that PayPal is deteriorating in quality and on a race to zero. However, what they all crucially ignore is that all two-sided payment networks, like Visa, Mastercard, Amex, etc., all have much lower gross margins on enterprise merchants.

This is by design. You want to drive as much usage and demand as possible in the largest merchants with your consumer side of the network, who then, in turn, visit the long-tail of SMB merchants where you can extract significantly higher gross margins. This is how every dominant two-sided payment network operates.

PayPal’s gross margins are still superb at around 41% for the LTM, much higher than Stripe (20%) and Adyen (16.3%). PayPal’s two-sided network gives them strong, long-term protection of their gross margin. While Stripe and Adyen are at far higher risk of having further margin erosion over time due to not having a two-sided network.

The more Braintree grows, the more PayPal and ‘Pay with Venmo’ APMs can be used by the consumer side of the network. This will help drive high margins from their PPCP merchants (Branded Checkout).

PayPal Complete Payments (PPCP):

PayPal Complete Payments (PPCP) is the company’s payment solution for SMBs or large enterprises that do not need customization. It’s an out-of-the-box, simple integration and uses the same backend as Braintree. By default, it includes all the current and future high-margin branded APM buttons like PayPal, ‘Pay with Venmo’, BNPL, etc.

Currently, 50% of SMBs use PPCP through channel partners like website content management systems (CMS), cloud accounting software, e-commerce plugins, and gateways. Most of PayPal’s largest channel partners have already integrated with PPCP, and this means PayPal can distribute to thousands of SMB merchants very quickly. The SMB merchant just has to make a PayPal account and enable PPCP on their e-commerce platform of choice.

WooCommerce is a great example; it is an e-commerce plugin for WordPress CMS websites and has 4.4 million SMBs using the plugin. Many of WooCommerce’s merchants use PPCP, and since integrating with PPCP, they've seen a 40% increase in checkout conversion and a 10% boost in pay-later activations through PayPal.

PPCP is continuously improved and optimized for conversion by PayPal and can automatically update all merchants to the latest version. This provides consistency in user experience across all of PayPal’s 35 million merchants - something that was impossible in the past.

PPCP is where the company will generate the majority of its margins now and into the future. These merchants pay 3.49% plus 49 cents for the branded APMs and 2.99% plus 49 cents for standard credit and debit cards. PPCP also has value-added services like Payouts, Invoicing, Merchant Lending, In-Store (Card Present), Risk-as-a-Service, and FX-as-a-Service. These all have high gross margins and further improve the value proposition for SMBs. With each value-added product that an SMB uses, they become less likely to churn from the network, providing further defensibility of these crucial long-tail merchant nodes.

The SMB payments space is fairly competitive, and PayPal’s strongest rival is Stripe. The strategy that Stripe uses is more to compete on price and offer slightly lower processing rates than PayPal. However, they suffer from the fact that they have no branded APM buttons that they also control, and their funding mix is essentially the exact same as other legacy acquirers. This makes their business have about half the gross margins of PayPal’s, and they will likely suffer from further commoditization over time. PayPal also provides a revenue share with their channel partners, incentivizing them to offer PPCP over other gateways that have much less gross margin to share with the channel partner.

PayPal is insulated from this processing rate race to zero due to their branded APMs (PayPal, ‘Pay with Venmo’, and BNPL) having much higher conversion rates than traditional manual entry. Sure, Stripe offers other APMs, like Apple Pay, Google Pay, etc., that have similar conversion rates, but the funding mix is significantly higher than PayPal’s APMs (due to ACH and debit mix). PayPal is able to use this higher margin to keep incentivizing its consumer side of the network (with cashback and rewards), making it a very attractive APM for consumers. Again, more demand and usage from consumer nodes drive more demand with merchants, which in turn increases the value of the whole two-sided network. This makes it unlikely that SMB merchants would consider leaving the network, and recent data backs this up.

You can see this strength of PayPal’s merchant retention versus the likes of Stripe when looking at a recent SMB survey conducted by PYMTS Intelligence. They spoke with 509 US-based SMBs doing under 10m a year in revenue. PayPal was the most used, with around 38.6% of SMBs using it as their primary PSP, compared to Shopify with only 7.1% and Stripe with 1.9%. They asked these businesses if they were considering switching their current payment processor in the next three years.

Merchants using Fiserv were the most likely to want to switch, with 47.2% saying yes; next was Stripe at 36.7%, Shopify at 25.4%, Chase Paymentech at 23.7%, PayPal at 14.5%, Quickbooks at 10.3% and Square at 8.2%. Note that Square is primarily for in-person payments and very little e-commerce, and Quickbooks is mainly for invoicing.

Even though PayPal increased its pricing for branded checkout by 20% in 2021, its SMB merchants are still less likely to want to switch than those with Stripe, which charges much less.

This illustrates the value of the network to these long-tail SMB merchants. The increase in ease, efficiency, and effectiveness that PayPal provides them as a PSP is unmatched and only grows in strength over time.

The next-generation checkout: The network vault

PayPal’s next-generation checkout will utilize a network vault. The market does not appreciate or potentially understand the ramifications of this innovation.

PayPal currently has 5 billion financial instruments - 25% of the world's cards - encrypted in its network vault (excluding China). These are PayPal user's saved payment options like debit cards, credit cards, bank accounts, etc. This means that when a PayPal consumer account visits a PayPal-enabled checkout, they can easily purchase in one click instead of adding their card, name, address, etc. The checkout conversion difference for a one-click checkout (using an APM button) vs. having to fill out a guest checkout is huge, with an 80% increase in checkout conversion on average.

The reason for this conversion increase is simple - it is much easier and more efficient. There is less friction on the network flow - the transaction that moves between merchants and consumers. You click once, as opposed to filling out a form asking for your name, address, email, phone number, and card details.

Currently, nearly all payment gateways allow consumers, once they have paid, to save their financial instrument in a merchant's vault by creating an account for the website. Think of the times when you have used a new shopping website; they typically ask after you’ve paid if you’d like to save the card for future purchases. This means anytime you return to that same merchant, you can much more easily checkout, likely in one click. But it only works if you go back to the same merchant. At the moment, this saving of payment details is largely only achieved by large enterprise merchants like Walmart, Amazon, eBay, etc., as they are trusted brands as opposed to the tiny, long-tail merchants you’ve never heard of before (SMBs). Most consumers are not going to save their payment details with a shopping website that they barely know. This is common sense.

PayPal, with its next-generation checkout, is going to solve this problem for merchants and consumers with a network vault. I will explain it using an example transaction.

Let's pretend you go and visit one of PayPal’s 35 million merchants, a small online shop that sells gym equipment. Let’s also assume you’re not a PayPal user and don’t click the PayPal APM (the one-click buy option). You instead choose to fill out the guest checkout, which is a bit of a pain, but you complete it and buy the item.

What PayPal is going to do at this stage is let guests save this payment method for future purchases (probably on an opt-in basis).

Once you’ve used the guest checkout on a PayPal merchant once and saved your payment details, it will automatically vault the instrument to the entire network and enable you to then one-click buy at all 35 million PayPal merchants (using your email and mobile as 2FA).

So now, whenever you visit any other PayPal merchant, you will convert at potentially a 50% to 80% higher rate than you would if you had to fill out the guest checkout every time. You would enter your email at the check-out, and PayPal will then send you a 2FA code to your mobile. Once you’ve entered the 2FA code, it will prefill all your details, including your financial instrument of choice, name, and shipping address.

PayPal has around 1 billion consumers using their checkouts every year, with many of these not yet PayPal users and many of them using the manual entry guest checkout. This opportunity is massive and completely underappreciated by the market. If PayPal can convert large swaths of these guests into much higher converting one-click buyers, the increase in auth rates and checkout conversion is hugely valuable for merchants. The network becomes significantly more efficient and effective for both sides.

Put yourself in the shoes of a merchant who has just signed up with PayPal. You are a new business, and you don’t have any brand cachet with consumers. From day one, all the millions of vaulted consumers in PayPal’s network will be able to one-click-buy at your checkout, and you will likely have far higher conversions and sales as a result.

PayPal is also the only payment service provider that has built a strong brand with consumers for being trustworthy and safe. The likes of Adyen and Stripe are largely unknown to the average consumer. If anyone is going to be able to pull this off, it is PayPal. The survey data I collected on October 21st also backs this up. When 991 US consumers were asked to select which brand they trusted most out of PayPal, Adyen, and Stripe (with their logos also shown), 95.5% chose PayPal. Stripe by 4.5% and Adyen, not by one single person.

PayPal is well-known by consumers, and they can use this to their advantage. Management has also conducted studies to see if consumers will be confident in saving their details with PayPal, and from all reports, the results were promising. PayPal can also incentivize consumers to save their details in return for a one-off discount or rebate on their purchase.

Over the next ten years, the guest checkout will likely become a much smaller share of the checkout payment volume vs. APMs. PayPal potentially being the primary beneficiary of this shift in volume due to its network vault and next-generation checkout.

Dan Schulman explained the idea in their recent presentation in June 2023:

“Yes. So when we talk about next-generation checkout … the idea behind that is that for many merchants, we do about – depends on the merchant obviously –call it 15% to 20% of their overall checkout [volume]. We do that predominantly in a one-click fashion. But there's still 80% of a merchant's checkout that does not go through PayPal. And we have the ability to use our network vault, which is probably one of the largest vaults of financial information in the world, some 5 billion [funding instruments] cards and information in that, to be able to help a merchant be able to do a single click checkout on the rest of their transaction. And we think that we can significantly increase the authorization rate on those transactions, many of them card entry and that kind of thing, and by doing so, collect more information data, be extraordinarily strategically of value to the merchant and then take that information and start to upgrade those clients to PayPal accounts to the value added services that we can offer. So we have a lot of enthusiasm from merchant customers to do that because of the advantages they could have. We will start very small in this, either later this quarter or the fourth quarter, and then start to roll that out as we get into 2024.

And I guess the other thing .., just to think about is the amount of data that we're collecting right now through unbranded, we're serving probably well in excess of 1 billion customers. Most people think about the 400 million [active consumer accounts] that we have today, but you've got 1 billion-plus customers working through those FIs that are vaulted through Braintree and others. When you've got that kind of scale and then all of a sudden, you can be a customer going to any one of the 30 million-plus merchants and having a one-click checkout experience across either PayPal or the other 80% of checkout, that is so compelling for merchants because as JK [John Kim] was saying, if you're just putting in all of your credit [or debit] card information, you've got a 50% to 60% conversion. PayPal, you've got closer to a 90% conversion. We think we could take that other 80% [of checkout] and convert it, maybe not to the same as PayPal, but up, say, 80% plus. That radically redefines checkout for merchants, way better economics for them, and we can charge for that, and way less friction for a consumer. And nobody else can do that right now. Nobody has the scale to do it. If somebody has like 30 million consumers out there, which you think typically, that will be a lot of scale, that's nothing because you can't really go from one merchant to another with that kind of vault and have that same seamless experience. And so I think this will redefine checkout for merchants, for sure, and for consumers. And then as JK was saying, once you have that guest checkout, who has now gone through guest checkout at that high conversion rate, we'll then immediately drive them into the PayPal app, through package tracking, whatever it may be, and then start to convert them into a full PayPal account. And the amount of growth we can have through that and the amount of new margin structure that we can drive from that could be game-changing for us”.

This next generation of checkout gives shareholders a significant margin of safety with PayPal’s future growth. If this new checkout only works a tenth of how good management thinks is possible, PayPal will likely retain its current branded market share and growth rate of slightly above overall e-commerce growth. The efficiency and conversion improvements it brings for both sides of the network are potentially huge.

It will take a few years to execute before results start becoming evident, but if management can get even one in five guest users to save their details, whether through using incentives or not, the results could be very impressive. Shareholders will own an even more defendable stream of growing future cash flows, and the optionality of this next-generation checkout is not priced in.

Management and Capital Allocation

Under Dan Schulman’s tenure as CEO, there were a number of acquisitions that were made at inflated prices and others that have eviscerated billions of dollars in capital. This is an unfortunate truth. A lot of M&A made by management teams is poorly done, and if PayPal had acquired Pinterest, that could have been a disaster for shareholders (thankfully, they failed).

PayPal’s new CEO, Alex Chriss, while at Intuit, made the mistake of paying too much for Mailchimp, which has already been written down by $3.4 billion. This history of painful mistakes is a good teacher and reminder for the current PayPal management team. They should all be well aware of how difficult M&A is to integrate and execute successfully. Chriss especially should have a very high bar to clear for future M&A, and that capital will instead be returned to shareholders through buybacks.

PayPal has a clean balance sheet with significant free cash flow generation and has a current share buyback program approved by the board of $15 billion. During the last three quarters, the company has bought back approximately 42 million shares, representing a decrease of 5% of shares outstanding since Q4 of 2022. It is likely they will continue returning cash to shareholders for the foreseeable future.

ROIC

PayPal’s two-sided network is like a toll booth on global e-commerce growth. Much like other payment networks, Visa, Mastercard, and American Express, there is a long-run way to compound capital at high rates of return - likely for many decades. E-commerce is projected to grow at around 9% for the next decade, and PayPal’s branded TPV generally outpaces this by a few percent YoY.

PayPal has, since the sale of its credit receivables portfolio to Synchrony Financial in 2018, maintained a ROIC of above 15%. Management has made it clear that with the KKR deal to buy European-based PayPal BNPL receivables, they will likely do the same with the global BNPL receivables - ensuring that the business can maintain high ROIC.

It seems probable that with PayPal maintaining its position as the largest and most dominant two-sided e-commerce payment network, the returns on invested capital will remain persistently high in the low 20s. It is a long-term compounder that will only get better with time.

Conclusion on Network Health and Investor Fears

The aim of this piece was to assess the business using first principles. To scrutinize this two-sided network with a fine tooth comb, looking in depth at both the consumer and merchant nodes. To find whether PayPal’s network is getting stronger or weaker.

Looking at the consumer side first, we can see that the churn of very low-quality users is actually good for the network and shareholders in the long run. The slight decrease in NNAs that investors are panicking about is not actually an issue, and instead, they should focus on the growth in high-quality MAUs. This renewed focus on quality by management has translated into new users with much higher TPAs and ARPU. We’ve also seen in the recent consumer survey that I conducted that PayPal remains the dominant APM choice by US consumers vs. Apple Pay and Google Pay - across all age categories. This fear of investors that PayPal’s consumer side of the network is crumbling is completely overblown and unfounded. Again, the NNAs slightly decreasing is not an issue and will be only temporary as PayPal churns out these low-quality users acquired during COVID.

Venmo has substantial upside, not priced in at all by the market. It is a call option that currently comes free when you buy PayPal. With the adoption of ‘Pay with Venmo’ by more and more large merchants who are incentivized to save on fees due to the low-cost funding mix, usage by consumers will only grow. This, in turn, helps drive more usage with the long tail of PayPal’s SMB merchants, who will generate very high gross margins for the company.

PayPal doesn't just dominate on the consumer side of the network but also with merchants of all sizes. They have the highest acceptance of all APMs in the top 1500 online retailers, with nearly 80% accepting PayPal, and have also outgrown or matched all competitors in acceptance over the last few years. PayPal has also done the same with the top 40,000 online retailers, again outgrowing their APM competitors over the last three years and adding two times more net new active merchants per month. This value that PayPal’s two-sided network provides is evident in its significantly lower merchant churn numbers, nearly four to six times lower than APM competitors.

Braintree continues to grow at very high rates, taking share from both legacy acquirers but also the likes of Adyen. Helping PayPal to get its branded APM buttons into as many large enterprise checkouts as possible to drive further consumer usage. Gross margins will slightly decrease over the short term as a result of this 30%+ YoY growth in TPV, but with the rewards of higher margins from SMB merchants down the line because of the increased APM usage by consumers.

The next-generation checkout is the icing on the cake, giving investors a significant margin of safety with the health of PayPal’s network over the next decade.

In summary, PayPal’s two-sided network is in excellent shape and is extremely well-defended. While not the perfect business, it is still of very high quality. We can be reasonably confident that with this continued health and defense of the network, future cash flow generation will also be highly defendable long into the future.

Valuation

The market currently has PayPal trading at an NTM FCF yield of approximately 11%. Considering the high quality of this two-sided network, this is a meager price to pay for such a superb business. The margin of safety is huge. The two-sided network is growing in its defensibility of key nodes and usage by nodes. Future cash flows can also be expected to be very defendable. This is a once-in-a-lifetime buying opportunity for the patient investor who can focus purely on the fundamentals rather than market sentiment.

No one is building another PayPal. The biggest threat I would see is if tech giants like Apple, Google, or Amazon bought Adyen or Stripe, enabling them to have their own two-sided network of merchants and APM users. However, from a regulatory standpoint, this would be close to impossible to get through the EU and US regulators.

The only two real long-term threats I see for PayPal are from regulators on anti-trust grounds and from management making colossal mistakes with capital allocation; however, with painful past mistakes, it seems probable they will choose the easiest option of just returning cash to shareholders.

Over the last decade, PayPal has grown FCF at around 18% YoY. We can conservatively expect that the company can grow FCF somewhere between 5% to 18% YoY over the next decade.

Given PayPal's present share price of $56.39, the projected ten-year CAGR ranges from 11% to 29%.

The lower estimate assumes no growth in NTM FCF, relying solely on the 11% yield, while the upper estimate assumes the 11% yield plus annual growth of 18% in FCF.

It’s likely that the return will fall somewhere in this range, probably above 20%, with FCF growing in the high single digits or in the low teens.

PayPal has a significant margin of safety due to the strength of the network, clean balance sheet, and continued stock repurchasing by management.

Where I would look further in researching PayPal:

Conduct more consumer surveys on APM usage and preferences and see how incentives, rewards, and cashback may alter behavior

Speak with management to get their thoughts on capital allocation going forward, next-generation checkout and how they are going to convert guest checkouts to save their details, how they plan on further strengthening the network, their thoughts on the future of ‘Pay with Venmo’

Get the latest Earnest Analytics card data to see the funding mix for Venmo and PayPal for 2023

Speak with large enterprise clients about ‘Pay with Venmo’ and their thoughts regarding the APM, conversion rates, and cost

Speak with large enterprise clients of Adyen, Braintree, and Stripe and get more insights into auth, loss, and processing rates between the three PSPs.

Get access to more merchant checkout data to see the different conversion rates between APMs, APM usage growth over time, and APM market share by vertical

Speak with channel partners regarding PPCP, revenue share compared to other PSPs, and checkout conversion rates.

Demographic data from the October 21st Consumer Survey on APM choice/preference:

Total Sample Size: 991

Male: 49.8% of those surveyed

Female: 50.2% of those surveyed

Mean Age: 38

Median Age: 35